Hey there! Today, I want to dive into a topic that’s incredibly important for anyone involved in marketing: Customer Acquisition Cost, commonly known as CAC. If you’re running a business or working in marketing, understanding CAC is crucial for your success. So, let’s break it down in a way that’s easy to grasp, yet thorough enough to give you a solid understanding.

What is Customer Acquisition Cost (CAC)?

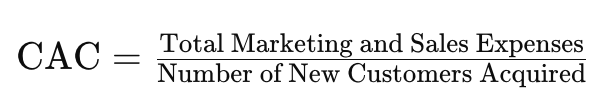

Customer Acquisition Cost (CAC) is a metric that tells you how much it costs to acquire a new customer. It’s a key performance indicator (KPI) that helps businesses evaluate the efficiency of their marketing and sales efforts. Essentially, CAC is the total cost associated with convincing a potential customer to buy your product or service, divided by the number of customers acquired in a given period.

To put it simply, CAC includes all the money you spend on marketing and sales—like advertising, salaries, software tools, and more—divided by the number of new customers you gain. It’s a straightforward calculation, but its implications are profound.

Why is CAC Important?

Understanding CAC is vital for a few reasons:

- Budget Allocation: Knowing your CAC helps you allocate your marketing budget more effectively. If you know how much it costs to acquire a customer, you can make more informed decisions about where to spend your money.

- Profitability: CAC directly impacts your profitability. If it costs you more to acquire a customer than what you earn from them, your business won’t be sustainable in the long run.

- Growth Strategy: CAC helps you refine your growth strategies. By analyzing this metric, you can identify which marketing channels are most cost-effective and focus your efforts there.

How to Calculate CAC

Calculating CAC is fairly straightforward. Here’s the basic formula:

For example, if you spent $10,000 on marketing and sales in a month and acquired 100 new customers, your CAC would be $100.

However, it’s essential to consider all relevant expenses, including:

- Advertising costs (online and offline)

- Salaries of marketing and sales personnel

- Software and tools used for marketing automation and customer relationship management (CRM)

- Content creation costs (blogs, videos, social media)

- Event costs (trade shows, webinars)

Reducing Your CAC

Once you have a handle on your CAC, the next step is to work on reducing it. Here are some strategies to help lower your CAC:

- Optimize Your Marketing Channels: Focus on the channels that bring in the most cost-effective leads. Use analytics to track which campaigns perform best and allocate more budget to those.

- Improve Your Sales Funnel: Streamline your sales process to convert leads more efficiently. This could involve better lead nurturing, improving your sales pitch, or providing more training for your sales team.

- Invest in Customer Retention: It’s often cheaper to retain existing customers than acquire new ones. Invest in customer service, loyalty programs, and upselling strategies to maximize the value of your existing customer base.

- Leverage Automation: Marketing automation tools can help you streamline repetitive tasks, personalize customer interactions, and ultimately reduce costs.

The Relationship Between CAC and Customer Lifetime Value (CLV)

It’s essential to look at CAC in conjunction with another crucial metric: Customer Lifetime Value (CLV). CLV represents the total revenue you can expect from a customer over their entire relationship with your business.

The goal is to have a CLV that is significantly higher than your CAC. A good rule of thumb is to aim for a CLV to CAC ratio of at least 3:1. This means that the revenue generated from a customer should be at least three times the cost of acquiring them.

Tracking and Analyzing CAC

To get the most out of your CAC analysis, you need to track it over time and analyze the trends. This will help you understand how changes in your marketing strategy impact your acquisition costs. Use tools like Google Analytics, CRM software, and marketing dashboards to monitor your CAC regularly.

Final Thoughts

Understanding and managing your Customer Acquisition Cost is fundamental to the success of your marketing efforts and overall business strategy. By keeping a close eye on your CAC, optimizing your marketing channels, and balancing it with Customer Lifetime Value, you can ensure that your business grows sustainably and profitably.

Remember, every business is unique, so it’s essential to tailor your approach to fit your specific needs and goals. Keep experimenting, analyzing, and refining your strategies, and you’ll be well on your way to mastering CAC and driving your business forward.