In the bustling world of marketing, acronyms and jargon fly around faster than we can catch them. One of the terms you might have heard buzzing in marketing circles is LTV, or Customer Lifetime Value. If you’re anything like me, you’re probably wondering what all the fuss is about. Well, let’s dive into it and break it down in a way that’s easy to understand and, more importantly, useful.

What is LTV?

LTV stands for Customer Lifetime Value. In simple terms, it’s a metric that estimates the total revenue a business can expect from a single customer account throughout their relationship with the company. This isn’t just about the first purchase; it’s about the entire journey. From repeat purchases, upsells, cross-sells, to renewals, LTV encapsulates all the interactions a customer has with your business.

Why is LTV Important?

Understanding LTV is crucial for several reasons:

- Resource Allocation: Knowing the LTV of different customer segments helps you allocate your resources more effectively. For example, if you know that customers acquired through a certain channel have a higher LTV, you can invest more in that channel.

- Customer Retention: LTV is a great indicator of customer loyalty. A higher LTV usually means that customers are happy and keep coming back. This can help you identify which strategies are working and which ones need improvement.

- Business Valuation: For startups and businesses seeking investment, a higher LTV can make your business more attractive to investors. It shows that your business model is sustainable and that you have a loyal customer base.

- Marketing Efficiency: By understanding LTV, you can calculate your return on investment (ROI) for various marketing campaigns more accurately. This helps in tweaking and optimizing your marketing strategies.

How to Calculate LTV

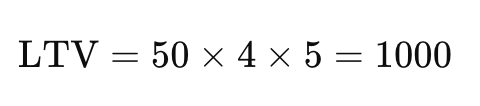

Calculating LTV might seem daunting, but it’s pretty straightforward once you break it down. Here’s a basic formula to get you started:

Let’s break this down:

- Average Purchase Value: This is the average amount a customer spends each time they make a purchase.

- Purchase Frequency: This is how often the customer makes a purchase within a given timeframe.

- Customer Lifespan: This is the average length of time a customer continues to make purchases from your business.

For example, if the average purchase value is $50, the purchase frequency is 4 times a year, and the customer lifespan is 5 years, the LTV would be:

This means that, on average, a customer will generate $1000 in revenue for your business over their lifetime.

Enhancing Your LTV

Understanding LTV is just the beginning. The real magic happens when you start taking steps to enhance it. Here are some strategies to consider:

- Improve Customer Experience: Happy customers are loyal customers. Invest in improving your customer service, user experience, and product quality. Make every interaction count.

- Implement Loyalty Programs: Reward your repeat customers with loyalty programs. This not only encourages repeat purchases but also makes your customers feel valued.

- Upsell and Cross-sell: Train your sales team to suggest higher-value products (upselling) or complementary products (cross-selling) during the purchase process.

- Personalize Marketing Efforts: Use data analytics to understand your customers’ preferences and behaviors. Tailor your marketing messages to meet their needs and interests.

- Retargeting Campaigns: Use retargeting campaigns to bring back customers who haven’t made a purchase in a while. Personalized emails and special offers can work wonders here.

Measuring and Monitoring LTV

To truly benefit from LTV, it’s important to measure and monitor it regularly. This involves:

- Segmentation: Break down your customers into segments based on their LTV. This can help you identify high-value customers and tailor your strategies accordingly.

- Analytics Tools: Utilize analytics tools to track customer behavior and transactions. Tools like Google Analytics, CRM systems, and specialized LTV calculators can be incredibly helpful.

- Regular Reviews: Set up regular reviews to analyze your LTV data. Look for trends, anomalies, and opportunities for improvement.

Final Thoughts

Understanding and optimizing Customer Lifetime Value (LTV) is a game-changer for any business. It not only helps you understand the true value of your customers but also guides you in making informed decisions about marketing strategies, resource allocation, and customer retention efforts.

Remember, it’s not just about acquiring new customers; it’s about nurturing and maximizing the value of the ones you already have. By focusing on enhancing LTV, you can build a loyal customer base, drive sustained revenue growth, and ultimately, achieve long-term business success.

So, the next time you hear someone talking about LTV, you’ll know exactly what they mean—and more importantly, how to leverage it for your business’s advantage. Happy marketing!